child tax credit 2021 dates canada

Child Tax Benefit Dates 2022. This is paid quarterly and the acfb payment dates for 2022 are.

Home Renovation Tax Credits In Canada Wowa Ca

Canada child benefit payments change every July based on your.

. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Your Canada child benefit is based on your family income from the previous year the number of children in your care and the age of your children. However the age tax credit amount depends on your income.

Individuals should review the information below to determine their eligibility to claim a Recovery Rebate. The CCB will pay more than the additional 1200 CCB. This means you can reduce your 2021 federal tax bill by 1157 15 of 7713.

The CRA makes Canada child benefit CCB payments on the following dates. Here is the full list of bank holidays for 2021 and early 2022. ACFB payments are issued by the CRA in four installments.

All payment dates. One of the best things about having children in Canada compared to other countries is getting a bit of a financial supplement from the government for doing so. The CRA has increased the regular CCB amount after adjusting the payment for inflation and income.

Canada child benefit payment dates. In this article I cover the Canada Child Benefit payment dates for 2021 and 2022 CCB amounts eligibility requirements increases and how to apply. The deadline for most Canadians to file their federal income tax and benefit return for their 2021 taxes is May 2 2022.

October 5 2022 Havent received your payment. However the refundability of the credit is limited similar to the 2020 Child Tax Credit and Additional Child Tax Credit. The CRA has made huge changes to the Canada Child Benefit in 2021.

The CRA created CCB to support mid- to low. Similarly the increased payments in the 2021-22 benefit period. The Child Tax Credit Update Portal is no longer available.

The Canada child benefit young child supplement CCBYCS provides support to families with young children in 2021. The Canada Revenue Agency CRA granted a one-time top-up of 300 in May 2020 to eligible Canada Child Benefit CCB recipients. The third round of Economic Impact Payments including the plus-up payments were advance payments of the 2021 Recovery Rebate Credit claimed on a 2021 tax return.

A cheque is either mailed to you or the funds are deposited in your bank account. The 500 nonrefundable Credit for Other Dependents amount has not changed. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. Families that have a child who is eligible for the disability tax credit may qualify for a Child Disability Benefit CDB and this payment is included in the CCB amount they receive. 15 opt out by Aug.

List of payment dates for canada child tax benefit cctb gsthst credit universal child care benefit uccb and working income tax benefit witb. For more information see Q B7 in Topic B. Posted by Puja Tayal Published February 23 2021 400 pm EST.

The maximum canada disability benefit for the period of july 2021 to june 2022 is 24291 per month or 2915 per year. Canada child tax benefit Universal child care benefit GSTHST credit Canada workers benefit Provincial and territorial benefits Childrens special allowances. 3000 for children ages 6 through 17 at the end of 2021.

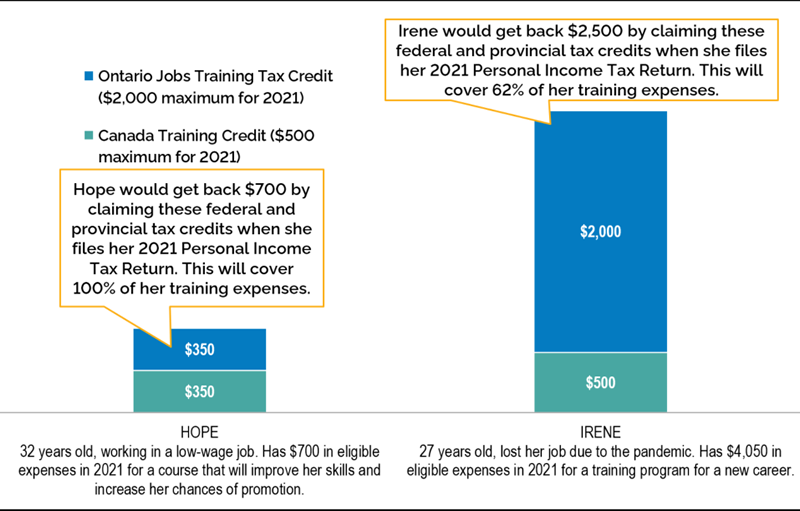

Alberta Child and Family Benefit Payment Dates. Tax tip by Marcelina SAF student and member of the Young Tax Professionals team. Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment.

3600 for children ages 5 and under at the end of 2021. By August 2 for the August. The maximum Canada Disability Benefit for the period of July 2021 to June 2022 is 24291 per month or 2915 per year.

Your five-year-old child can get you as much as 8000 in CCB. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the. TaxSeason Canada taxes UWaterloo.

Apply for child and family benefits including the Canada child benefit and find benefit payment dates. For 2022 the payment dates are. 13 opt out by Aug.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. While families do not need to apply separately for this supplement they must already be receiving the CCB for a child under the age of six and complete their 2019 and 2020 tax returns to get the CCBYCS payments. The CDB is included in CCB payments for those who qualify and payment dates occur on the same dates as the CCB as follows.

When It Is Deposited. TikTok video from UWaterlooSAF uwaterloosaf. In january 2022 the irs will send letter 6419 with the total amount of advance child tax credit payments taxpayers received in.

Here are the child tax benefit dates for 2021 so you know when you are going to get paid. The maximum Canada child benefit you could get is 6765 per year for children under 6 and 5708 per year for children aged 6 to 17. If your 2021 net income is below 38893 the CRA will.

Wait 10 working days from the payment date to contact us. In a case where your ACFB payment is under 10 for the. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. By august 2 for the august. It was issued starting in March 2021 and continued through December 2021.

Lets condense all that information. Eligibility Rules for Claiming the 2021 Child Tax Credit on a 2021 Tax Return.

Ccb Understanding The Canada Child Benefit Notice Canada Ca

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

What The Disability Tax Credit Means For Eligible Canadians And Their Families Advisor S Edge

Canada Child Benefit Ccb Payment Dates Application 2022

Canada S Tuition Tax Credit How It Works Nerdwallet Canada

Canada Child Benefit Payment Dates 2022 Filing Taxes

Ontario Jobs Training Tax Credit Ontario Ca

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

Going Native Was Produced With Participation And Assistance From Canada Media Fund Cmf Cptc Manitoba Film Music Mfm Participation Manitoba Tax Credits

Canada Child Benefit Ccb Payment Dates Application 2022

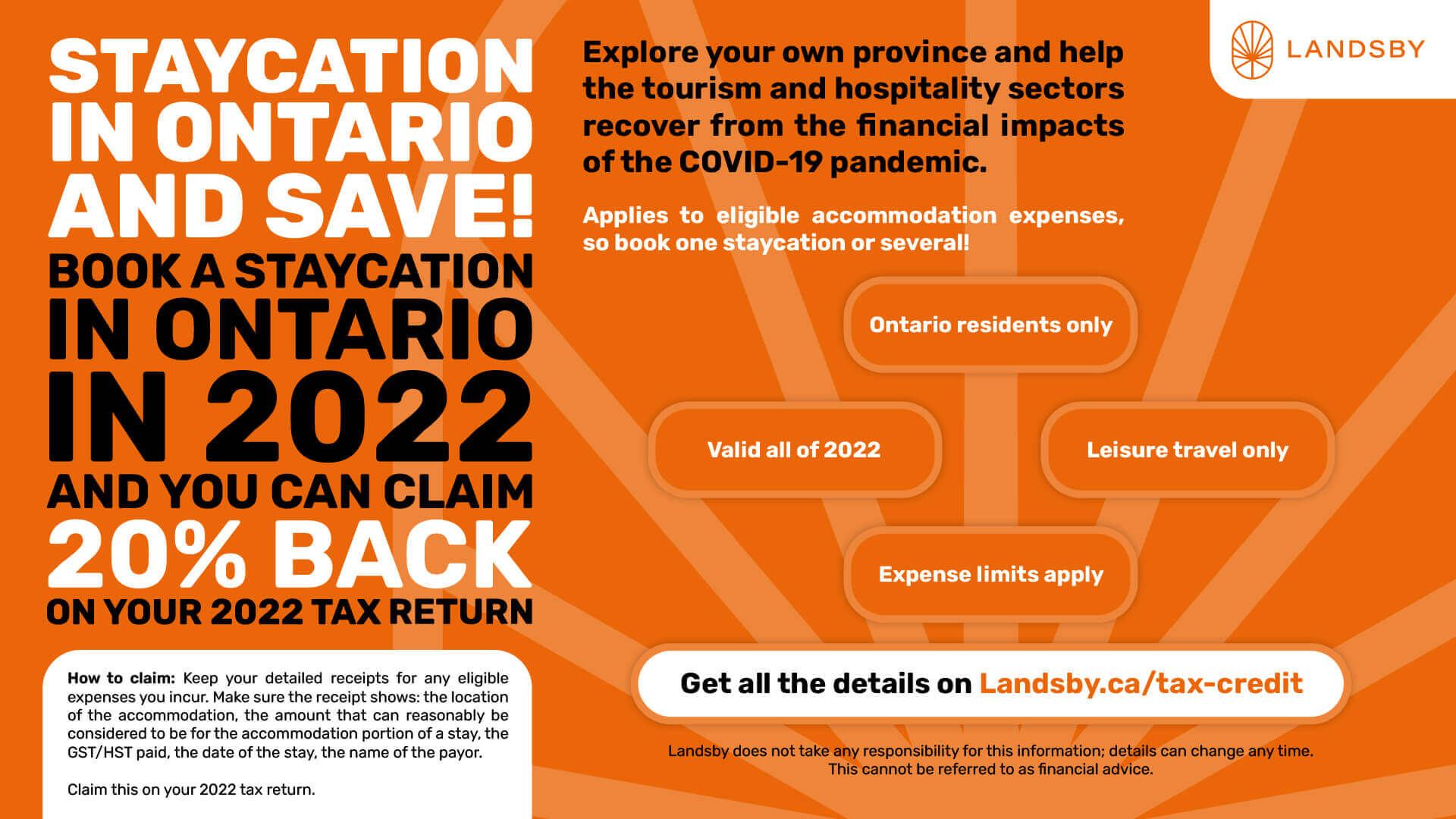

2022 Ontario Staycation Tax Credit Guide Landsby

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

How Can You Qualify For Disability Tax Credits For Adhd Parental Guide

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips