will the salt tax be repealed

The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is. As policymakers weigh whether to lift or repeal the 10000 cap.

Democrats Are Pushing Tax Breaks For The Rich They Ll Cry When Voters Punish Them David Sirota The Guardian

54 rows Some lawmakers have expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017.

. The salt tax however continued to remain in effect and was repealed only when Jawaharlal Nehru became the prime minister of the interim government in 1946 but later re-introduced via the Salt Cess Act 1953. 11 rows October 4 2021. SALT deductions were limited to 10000 as part of former President Donald Trumps tax reform plan in 2017 hurting residents of.

Unchanged is the SALT state and local income tax deduction cap. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the Urban-Brookings Tax. Its a blow for Schumer who is up for reelection this year and pledged in 2020 to make repeal of the cap on SALT deductions a top priority if Democrats won control of.

A new bill seeks to repeal the 10000 cap on state and local tax deductions. Insisted publicly that any version of Build Back Better repeal the SALT cap immediately or at least scale it back. This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031.

However altering the cap might make it easier for states and localities to raise taxes to pay for public services particularly as many states continue to feel the effect of the pandemic on their budgets. Itemizers facing high marginal tax rates with high state and local taxes would see the greatest impacts. In 2017 Trumps wide-ranging tax overhaul capped how much filers can deduct in SALT taxes up to 10000 that would last until 2025.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the cap were repealed. March 1 2022 600 AM 5 min read.

According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. But for dozens of House Democrats the measures uncertain economic impact is not their only risk in backing the bill. In addition it is always possible the SALT Cap will be repealed or the 10000 state tax deduction limit will be increased.

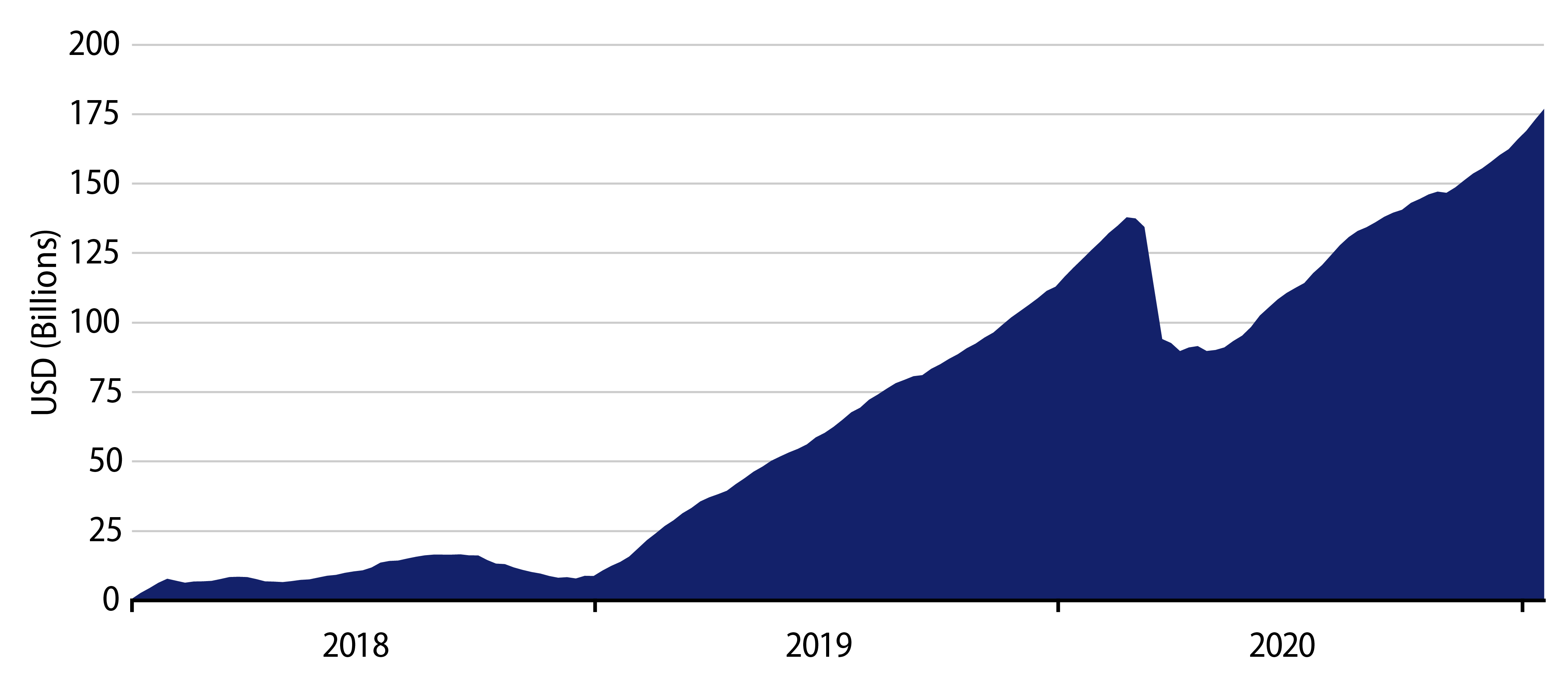

Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately. When SALT is repealed the taxes will be going down What he really means is if the cap is lifted overall state and federal taxes will be. Analyses found that repealing the cap would disproportionately benefit the wealthy.

On IRS to repeal Trump-era charitable deduction tax. After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say they will still vote for the partys spending package. Cap on State and Local Tax Deductions SALT remains because Democrats abandoned pledges to repeal it.

After the Senate passed their signature climate tax and healthcare package Sunday the action turns to the House. Most economists believe that a repeal of the cap on the SALT deduction would be regressive and costly to the federal government. The 10000 limit on the amount of state and local taxes deductible from federal income was enacted in 2017 and sunsets after 2025 under current law.

Nov 19 2021.

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Covered Wagon Barbecue And Stews In 2022 Covered Wagon Stew Barbecue

Lawmakers Who Ran On Salt Relief Prepare To Face Voters Roll Call

Lawmakers Who Ran On Salt Relief Prepare To Face Voters Roll Call

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

Salt Cap Repeal Demand Exposes Dem Tax Hypocrisy Americans For Tax Reform

Salt Cap Repeal Gains Steam Amidst Uncertainty Bond Buyer

How To Build A Fun Family Time Capsule Time Capsule Family Fun Time Time Capsule Kids

Salt Cap Repeal Demand Exposes Dem Tax Hypocrisy Americans For Tax Reform

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Did You Know England Introduced A Tax On Hats In 1784 To Avoid The Tax Hat Makers Stopped Calling Their Creations Character Fictional Characters Family Guy

The French Had A Salt Tax Called The Gabelle Which Angered Many And Was One Of The Contributing Factors To The French Rev French Revolution Angered Revolution

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

3 Money Saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money

The Tax Break Down The State And Local Tax Deduction Committee For A Responsible Federal Budget

Salt Cap Democrats Sneaking In Tax Cut For Wealthy Into Build Back Better Plan